Volatility is much easier to work with when it is consistent! Today was really challenging because a number of the momentum trades that I took reversed too quickly afterwards and in a number of cases exceeded the swing in the opposite direction. Oof.

Despite the losses today, it was still a very interesting day of trading, so there is that silver lining. In the first part of the session almost everything in the tech sector tested some lows before rebounding. What made the bounce back so fascinating is how volatile it actually was as most of the equities I followed traded horizontally with big pitched swings up and down.

My biggest losers were SMCI, which I exited too early. And some of my Tesla (TSLA) positions which I exited too late. The tricky thing about momentum trading with directionless volatility like today is there's not much method to the madness. Directions shift in an instant and one of the dangers of the long put option is that if momentum swings too far away from the strike price, it is really difficult to pull it back.

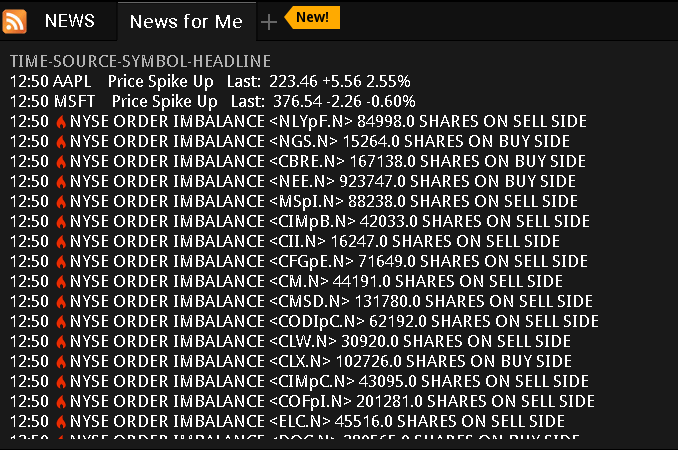

Towards the end of the session I saw a massive spike across my entire terminal and popped over to my news view to see a litany of order imbalances:

Fortunately for many of my positions the spike was short lived and I could place some overnight puts in on AMD. But the behavior was really shocking and I think it might have been related to the JP Morgan Hedged Equity Fund S&P 500 collar options which I heard a commenter on Bloomberg mention earlier in the day.

While trying to find more information about what exactly just happened I found this old blog post from a similar JP Morgan collar trade which has some interesting analysis to read!

Log

- No good news across the board before the open.

- Queued up some stub trades but not confident there will be much as far as long puts to consider.

- Shopify (SHOP) looking promising for more buying in pre-market, will have to watch that to see how low it can go before executing a purchase.

- Played the open well but SMCI rallied much more strongly than I expected and tanked my forward progress for the open.

- Stuck to the trading since there was a lot of volatility, in hind sight this was a bad idea!

- Just about every time I would perceive momentum and get an order in, the market would reverse. Tesla (TSLA) in particular kept turning sharply on me.

- Decided against buying into more Shopify (SHOP) and was not able to get any covered calls sold there. Lots of traders sitting on the sideline it seems for SHOP.

- Late in the session undid some of my TSLA damages from the morning with profitable long puts, just after exiting a massive order imbalance hit just about everything in the sector. I believe this was the collar spread on the S&P expiring.

Trades

- COST

- AAPL 11APR25 217.5 P

- AAPL 11APR25 220 P

- AAPL 11APR25 222.5 P

- AMD 28MAR25 108 C

- AMD 11APR25 108 C

- AMD 11APR25 102 P

- AMD 11APR25 103 P

- AMZN 11APR25 187.5 P

- AMZN 11APR25 190 P

- APP 11APR25 255 P

- AVGO 11APR25 167.5 P

- DDOG 17APR25 108 C

- INTC 11APR25 22.5 P

- NVDA 11APR25 106 C

- NVDA 11APR25 107 C

- NVDA 11APR25 105 P

- NVDA 11APR25 106 P

- NVDA 11APR25 107 P

- NVDA 11APR25 108 P

- RDDT 11APR25 103 P

- SHOP 28MAR25 100 C

- SHOP 28MAR25 103 C

- SMCI 11APR25 33 P

- SMCI 11APR25 34 P

- TSLA 11APR25 247.5 P

- TSLA 11APR25 250 P

- TSLA 11APR25 252.5 P

- TSLA 11APR25 255 P

- TSLA 11APR25 257.5 P

- TSLA 11APR25 260 P

- TSM 11APR25 167.5 P

Holding

- AMD

- DDOG

- IBKR

- SHOP