A lot of my trading is options trading. I don't have a good reason for this other than it is highly liquid and interesting.

My successful trades are usually "naked long puts" options, which is a pessimistic bet. In contrast to "naked long calls", an optimistic bet, which has consistently burned me. I am generally better at identifying overvaluation than under-valuations. Separately, I do also sell covered calls, but that's a topic for another day. In this post I want to outline the long put strategy I am employing, along with my thoughts on entry/exit timing, and market scanning.

Disclaimer Options trading can be scary. I worked with small single option trades for a long time before I ratcheted up my trade sizes and frequencies. Many options traders will recommend "paper trading" to develop your intuition. There are a number of other ways to ease into options trading in ways that limit your risk profile and can help build confidence. That is not the subject of this post, but generally speaking, please be careful when options trading.

With that said, here's an overview of the long put:

A long put is an options trading strategy where an investor buys a put option, giving them the right to sell a stock at a predetermined price before a specific expiration date, typically in anticipation of a decline in the stock's price. This strategy allows the investor to profit from falling stock prices while limiting their potential loss to the premium paid for the option.

I started adopting the long put for a lot of my trades as I became more cynical or bearish on the technology and semiconductor space. There has been a lot of discussion in the last few months about over-valuation in the technology sector. I generally agree with this sentiment, thus this strategy. I particularly like long puts because it is a way to trade on downturns in the market, without shorting stock which seems much more dangerous to me:

A long put may be a favorable strategy for bearish investors, rather than shorting shares. A short stock position theoretically has unlimited risk since the stock price has no capped upside.

Option value is generally (time value) + (intrinsic value). With put options,

the loss of time value has a pretty aggressive decay which makes it more

well-suited for short-term trades. For example, with a put option that is in

the

money

at the beginning of the day. If the stock trades sideways the whole day, the

time value can decay so much that it could go out of the money by the close.

I don't have strong data to support this, but I believe that put options time

value decays faster than call options, and I would attribute that to a natural

bias towards optimism by traders.

I try to avoid holding onto put options oversight to minimize the risk exposure to time value decay.

Strategy Overview

The approach has been fairly durable with markets going up and markets going down. Since I'm a momentum trader more than anything.

I generally like to buy put options around the current stock price, and select a time horizon from 1-2 weeks out. This keeps the premiums high while ensuring that the minute-to-minute fluctuation presents enough value change to be interesting to trade.

- Before open:

- Review the news of the day across the sector, including the general economic news. Tariffs, Federal Reserve, and other major market shifts will affect almost everybody in one way or another. This includes reviewing the day's economic events calendar.

- Review the charts of many of the symbols I follow, looking back the past couple days. Usually I am looking for patterns where they were trading sideways for a while, before seeing a noticeable uptick.

- Enter in a number of "candidate trades" at the money for options I am

interested in pursuing. I will usually enter this in with an order size of

1and a price well below the previous closing day. For example if Tesla (TSLA) is trading at $251/share then I will enter an order for a single put option at $250 for one to two weeks out.

- Pre-market

- The pre-market is the five minutes or so before open and watching the candidate trades can be a potential signal of which trades to be ready to execute.

- Momentum in pre-market doesn't automatically correspond to momentum that can happen in the open, but it can be an interesting signal that market makers and others are covering shorts.

- Open

- The open is when a lot of action happens, particularly in the first 15 minutes since this is when the most price action (change) will occur until the close.

- With technology stocks, especially those that are traded in Asia, there can be a big opening pop up followed by some momentum down, before some settling will occur. Many of my long put trades are attempting to identify the peak of this initial spike to buy the cheapest put option possible.

- Identtifying momentum is tricky. Most of my charts have either 30 second or 1 minute candles. I am usually looking for more than one candle of downward momentum with bids driving downward to signal a trade opportunity.

- I try to open and close all the long put options in the open part of the session. This means before I close the terminal I am not leaving any positions open that might cause me to stress.

- Mid-day

- Barring any planned economic news, I am not typically paying much attention during the middle of the day.

- The volatility can be minimal such as to not present enough momentum for trades outside of the open and close, there are some days where some stocks are subject to sudden panic or high-frequency-trading upticks or down-ticks. I may snipe some opportunities, but this is not the usual case.

- Close

- I try to avoid the close entirely since it's usually more optimistic than the open.

- Sometimes I will buy a long put in a closing rally, but those are more risky since I'm holding overnight. This is especially true with companies that have exposure to the Asian markets.

Example: RDDT

I don't usually trade Reddit (RDDT) since it is kind of a meme stock. I don't believe the company has good fundamentals that drive its valuation, its options carry a lofty premium and the stock price seems to fluctuate wildly based on nothing more than vibes.

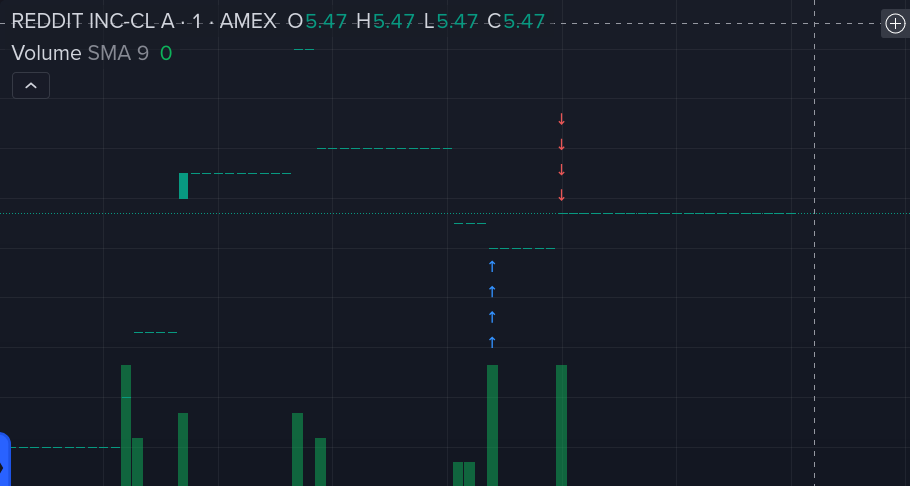

I wanted to highlight this example because the overall day was trending upwards but I was still able to find a momentum trade downwards to execute. Consider the blue arrows below. The left indicates a sudden pop upwards where I was able to buy long put options.

The blue arrow on the right is when the momentum changed and I sold the long put, pocketing the profit.

The next graph shows the narrowness of the spread on the put option itself, and the "buy" (blue) and "sell" (red) on the long put option price:

This trade was not big money, but it was profitable and low-risk. The goal is to be correct on the momentum as long as possible until the momentum shifts. I prefer more small trades with low risk rather than fewer larger trades with more substantial risk.

Downsides

The hardest part about long puts is contending with optimism bias in the market. To a large extent traders want the market to go up, and that psychology can lead to the market generally wanting to go against the long put option. The flip-side of this is when the market gets pessimistic, long puts can get very valuable as people scramble for the insurance offered by put options.

I mentioned time-value decay as one of the challenges with the long put strategy. Throughout the trading session the value of the put option will go down. This means unless there is a big down-tick your "investment" will depreciate, especially if the underlying stock drifts further above the strike price.

Riffing off the Reddit (RDDT) example earlier, if Reddit is trading sideways at approximately $120/share all day, the 120 Put will deprecate relatively slowly. However, if the price of RDDT is ascendant and pushes up towards $121/share, the 120 Put option value will more sharply decline.

What is double-trouble in this scenario is that the movement back downward must be more dramatic to drive the put option value back up to make the trade profitable.

To ameliorate these risks, I will typically:

Hold onto put options for as little time as possible. This can mean I will sacrifice value on a temporary uptick during a longer downward slide. For a series of candles of down, down, down, up, down, down. I am typically exiting the trade on that uptick to minimize risk.

Add stop orders in both profitable and unprofitable territory. For example when the value continues to increase towards my target, I will place a stop (STP) order "behind" the price changes before the option goes out of the money. A RDDT put I purchased for $1.00, that increases to $1.20 in value, I might put a STP in at $1.10 and leave a sell order in at around $1.50, or something along those lines, to ensure that profit can be made. For more negative value swings, picking a stop is much harder for me. Obviously nobody wants to lose money but it can be really difficult to identify a limit that will not exit the trade too early.

There was one day I was very confident that the uptick in SMCI was not sustainable and would come down. I held put options into some pretty severely negative territory, and ended up correct as the session approached the close. If I would have put a stop in, I probably would have just lost money.

A counter-example was misjudging a small downturn in a larger rally of Tesla (TLSA), the losses kept getting worse and worse, and I regretted not exiting at an earlier point where I literally said to myself "I should put a stop in."

The long put options strategy is an active trading strategy. It requires some attention to be paid to the overall market, as well as the sector in which the trading is focused. I stick to the tech sector generally because I both understand it and I am interested in the space.

While I am overall optimistic/bullish on the tech sector, it is an inherently difficult to value market which shifts regularly, making it ideal for long puts.

I hope you find this useful!