The phrase "economic softening" is starting to get thrown around a lot by journalists who don't want to own up to saying the groundwork for a recession is happening right now. Today's tech sector was largely drowned by Nvidia (NVDA) which dropped around 8%. I don't have any particular insights as to why today it dropped other than the lack of confidence from investors that they're going to skyrocket back up like they once did. I think barring any substantial announcement indicating major growth opporttunities, like a renewed demand from Chinese companies, the company is going to slowly slog back up in value as time goes on.

Joined in the fall of NVDA is Super Micro (SMCI), which also had a down day. My analysis of Super Micro was not terribly original, but the same conclusions are being shared by Benzinga. I really do think that the SMCI books smell fishy and I'm really not suhre if I would trust any numbers they say until a reputable auditor confirms that they're not actually cooking the books. I think there may have been some manipulation last year around the big AI rally that pushed their shares over $100/per; watching them drop to $38/share doesn't delight me but it does bolster my confidence in some of my analysis and decision-making.

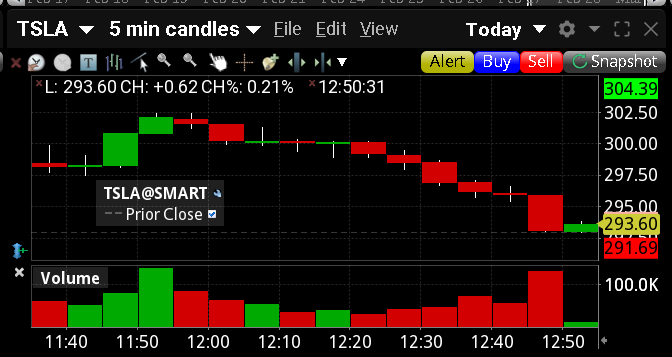

Today I focused totally on PUTs and bet against a number of stocks which had an initial unsustainable surge at the open. I also started trading Tesla (TSLA) for the first time since I believe some investors are starting to see that the hype isn't actually there.

|

|

I cannot think of any other company more substantially tied to the current administration, while also having pretty big exposure to the tariffs being proposed by President Trump. Steel, technology, labor, and the Chinese market, all wrapped up in one!

Today ended in the green for me, but I did leave some positions open to head into tomorrow as "tariff-opportunities" since I believe the tariffs on China are going to continue to adversely affect both SMCI and TSLA.

Log

- Determined to stay disciplined with put options today, foolish calls cause me nothing but pain!

- Looked at the overnights and spotted some potential opportunities with Spotify (SPOT) and a couple others. Also planned some anti-fascist puts against Tesla (TSLA) if the opportunity presented itself.

- Was able to get some good trades in right at the opening bell and had real-life distractions pull me away after 10 minutes. That's probably for the best, keeps me from being too foolish.

- Some of the puts I could have held longer for more profit, but had to kind of close everything in the opening in short order, so I'm glad to have smaller profit so I was able to pay more attention to things away from the terminal.

Trades

- AVGO 07MAR25 195 P

- NVDA 14MAR25 113 P

- RDDT 14MAR25 170 P

- RDDT 14MAR25 172.5 P

- SMCI 14MAR25 36 P

- SMCI 14MAR25 37 P

- SNOW 14MAR25 180 P

- SPOT 14MAR25 622.5 P

- TSLA 14MAR25 280 P

- TSLA 14MAR25 290 P

- TSLA 14MAR25 300 P

- TSM 14MAR25 172.5 P

Holding

- AMD

- DDOG

- IBKR

- VGK

Options

- AMD Mar14'25 115 C

- AMZN Mar07'25 215 C

- DDOG Mar14'25 124 C

- SMCI Mar14'25 36 P

- TSLA Mar14'25 280 P